Home Builder Stimulus Package, explained by Director Principal, Leon Mazarakis.

2020 is shaping to be the year that Australia wants to forget. Drought, flood, extreme bush fires, a killer global pandemic, tensions with our largest consumer of Australian product and now, race riots! Unemployment is back into double digits and after 29 years of growth, the economy is in recession. In recent memory, we have not seen more unstable times.

It is certainly a grim outlook. Surely the Prime Minister is being irresponsible, emptying the coffers and throwing billions of dollars into the economy. Or is he? Ever heard the phrase “you have to spend money to make money?”

We are indeed the lucky country! When compared to the rest of the world, we have actually come out O.K. following the advent of COVID-19. We still are rich in natural resources and we have a sophisticated workforce. With global demand slowing, our export trade is naturally in decline. Thus, if we did not spend domestically and prop the economy via these stimulus packages, the downturn would be much more severe.

Let’s be honest. Australians have a love affair with property. ScoMo’s latest “Home Builder” stimulus package gifts $25,000 tax free to encourage people to renovate their homes and/or build new homes, bolstering the construction industry, which employs millions of Australians.

Below is a summary of eligibility criteria for the scheme:

You must be an Australian Citizen.

The grant is only available to individuals, not company or trust structures.

The value of the property being constructed must not exceed $750,000 (including value of land).

The build contract must be entered into between 4 June and 31 December 2020. Construction must begin within 3 months of the build contract being signed.

The scheme is means tested. To be eligible, taxable income declared in FY19 must be:

<$125,000 for individuals and

<$200,000 for couples.

FAQs

How do I apply?

The application process will be handled by each State or Territory revenue office. The application forms are not yet available, however, at a minimum the following documents will need to be provided:

proof of identity;

a copy of the contract, dated and signed by you and the nominated registered or licenced builder;

a copy of the builder’s registration or licence (depending on the state you live in);

a copy of your 2018-19 tax return (or later) to demonstrate your eligibility against the income cap; and

documents such as council approvals, building contracts or occupation certificates and evidence of land value.

I am an Investor. Do I qualify for the grant?

Unfortunately, no. At the time of entering the contract you must intend to live in the property being constructed. If your circumstances change after you have applied for the grant but you have not yet received the payment, and no longer meet the eligibility criteria, you will need to notify the relevant State or Territory revenue office immediately.

I already own land but have not signed a contract to build a new house. Do I still qualify?

Yes! However, the value of the land and the build cost combined must not exceed $750,000.

When do I receive the payment?

This is not clear and will depend each State or Territory revenue office. Early indications are that payments will be made upon approval of applications once the construction has commenced. More information will be provided as the scheme is rolled out by each State or Territory revenue office

I am a permanent resident. Can I apply?

No. The Government has indicated that the grant is only available to people who are Australian citizens as at the time of entering in to the build contract.

This is not my first home. Do I qualify?

Yes! You still qualify for the grant even if this is not your first home.

I am a First Home Buyer. How does the grant impact me?

First home buyers will still be able to claim against State and Territory based first home incentive schemes in addition to this scheme and the Australian Government’s Home Loan Deposit Scheme and First Home Super Saver Scheme.

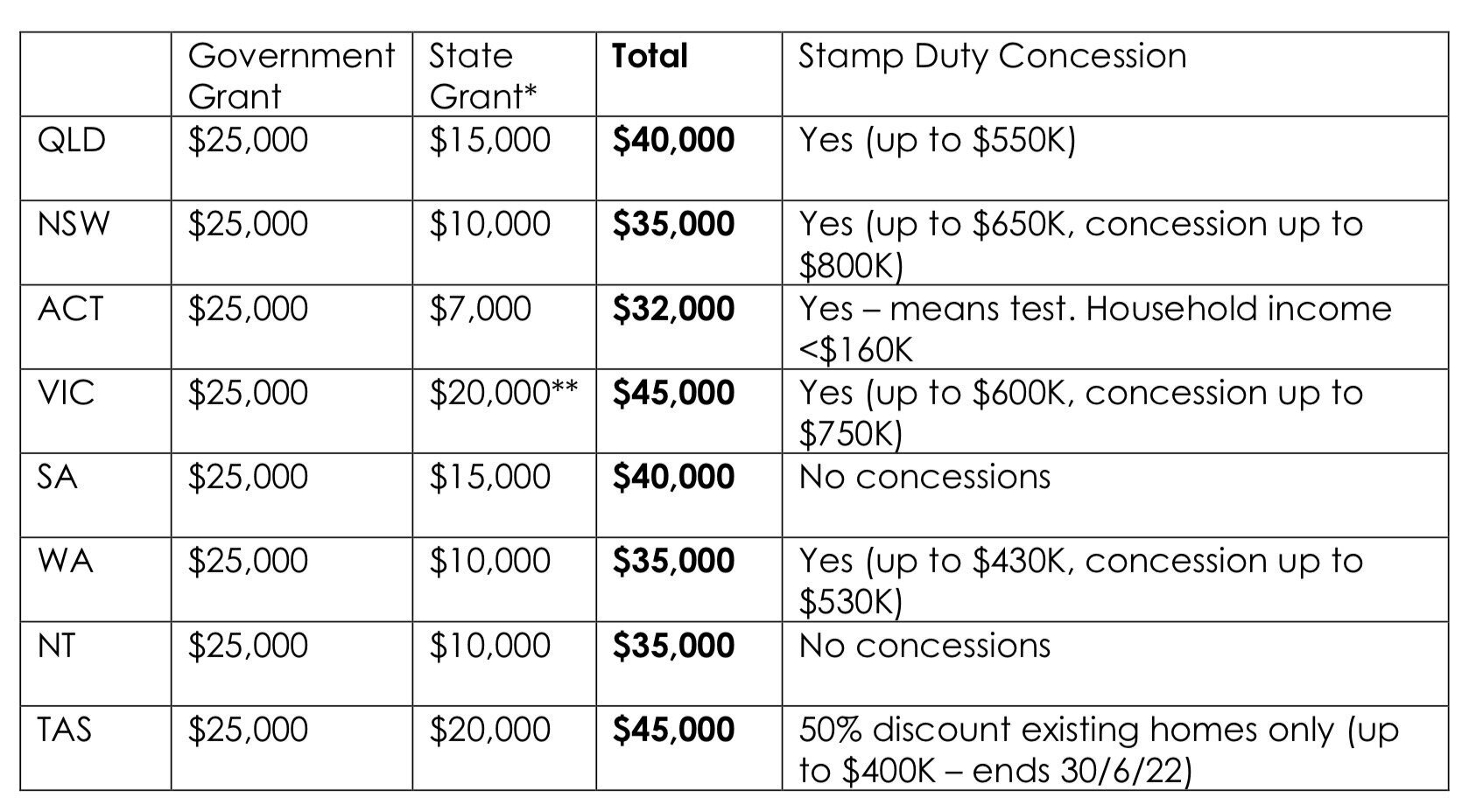

The below table shows potential benefits for each state.

*House value limits apply.

** Applies only if construction is in regional Victoria. Grant is reduced to $10,000 if construction is in metro areas.